Term vs Whole Life Insurance: Which Is Better for You?

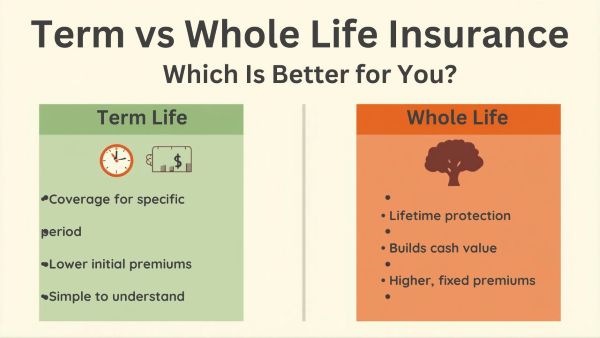

Choosing the right life insurance can feel overwhelming, especially when comparing Term vs Whole Life Insurance, two of the most popular options available today. Understanding how these policies work, their costs, benefits, and limitations is essential to protecting your family’s financial future and making a smart long-term decision.

In this detailed guide, we’ll break down everything you need to know about term life insurance and whole life insurance, helping you determine which option is better for your needs, budget, and financial goals.

What Is Term Life Insurance?

Term life insurance provides coverage for a specific period, or “term,” usually 10, 20, or 30 years. If the insured person passes away during the term, the policy pays a death benefit to the beneficiaries. If the term expires and the policyholder is still alive, coverage ends unless the policy is renewed or converted.

Key Features of Term Life Insurance

-

Lower premiums compared to whole life insurance

-

Fixed coverage period

-

No cash value component

-

Simple and easy to understand

Pros of Term Life Insurance

-

Affordable premiums

-

Ideal for temporary financial needs (mortgage, education, income replacement)

-

High coverage amount for a lower cost

Cons of Term Life Insurance

-

Coverage expires at the end of the term

-

Premiums may increase upon renewal

-

No savings or investment component

What Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides lifetime coverage, as long as premiums are paid. In addition to the death benefit, it includes a cash value component that grows over time on a tax-deferred basis.

Key Features of Whole Life Insurance

-

Lifetime protection

-

Fixed premiums

-

Guaranteed cash value growth

-

Can be used as a financial asset

Pros of Whole Life Insurance

-

Coverage lasts for life

-

Builds cash value you can borrow against

-

Stable and predictable premiums

-

Can support estate planning goals

Cons of Whole Life Insurance

-

Significantly higher premiums

-

Lower return compared to other investment options

-

More complex than term life insurance

Term vs Whole Life Insurance: Key Differences

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (10–30 years) | Lifetime |

| Premium Cost | Lower | Higher |

| Cash Value | No | Yes |

| Flexibility | High | Moderate |

| Investment Component | No | Yes |

Which Is Better: Term or Whole Life Insurance?

The answer depends entirely on your personal situation.

Term Life Insurance Is Best If You:

-

Are on a tight budget

-

Need coverage for a specific time period

-

Want maximum coverage at the lowest cost

-

Are supporting dependents or paying off debts

Whole Life Insurance Is Best If You:

-

Want lifelong coverage

-

Are planning for estate or legacy needs

-

Want a policy that builds cash value

-

Can afford higher premiums

Many financial experts recommend term life insurance for most people, especially young families, because it offers strong protection at an affordable price.

Can You Combine Term and Whole Life Insurance?

Yes. Some people use a hybrid strategy—buying term life insurance for immediate needs and a smaller whole life policy for lifelong coverage. This approach offers both affordability and long-term benefits.

How to Choose the Right Life Insurance Policy

Ask yourself:

-

How long do I need coverage?

-

What is my budget?

-

Do I need cash value or just protection?

-

Do I have dependents relying on my income?

Consulting a licensed insurance advisor can also help tailor the right solution.

Frequently Asked Questions (FAQs)

1. Is term life insurance better than whole life insurance?

Term life insurance is better for most people due to its affordability and simplicity, while whole life insurance suits long-term financial and estate planning needs.

2. Can I convert term life insurance to whole life insurance?

Many term policies allow conversion to whole life insurance without a medical exam, depending on the policy terms.

3. Does whole life insurance really build cash value?

Yes, whole life insurance includes a guaranteed cash value that grows over time and can be borrowed against.

4. What happens when term life insurance expires?

Coverage ends unless you renew, convert, or purchase a new policy.

5. Which life insurance is best for young adults?

Term life insurance is generally the best option for young adults due to low premiums and high coverage.

Check Our Latest Uploads

Top Skills You Must Learn for 2026 to Future-Proof Your Career

HMO vs PPO vs EPO: Which Health Insurance Plan Should You Choose?